Mailman delivers cash flow, don’t count on it!

May 5, 2014 at 3:07 pm | Posted in Uncategorized | Leave a comment

9 Rules of Cash Flow

March 21, 2014 at 3:47 pm | Posted in Uncategorized | Leave a commentThe 9 Rules of Cash Flow

according to Judi Johnstone, Vice President Business Development fvftoronto@aol.com

Turning “paper” into “paper”, seriously!

March 21, 2014 at 3:25 pm | Posted in Uncategorized | Leave a commentTags: document flow, purchase order financing, receivable financing

DOCUMENTATION DRIVES YOUR CASH FLOW REQUEST

Relying on the document flow of your business, coupled with your time honored relationships with your suppliers and your customers may give you better access to higher amounts of funding without diluting your equity in your business.

Three documents make up a receivable. First, you have the purchase order, followed by the invoice and lastly, the proof of acceptance by your customer.

When a new order is taken, being able to rely on the abilities of your suppliers, based on the history you have with them and the strength they have in the marketplace, can help you attain valuable time with which to run your business effectively, not tapping into your lines of credit or personal security. Proper documentation, coupled with your abilities to produce the product in the manner in which your customer expects, will garner net 30 day terms in some cases with your suppliers. The suppliers comfort in knowing that your purchase order to them is supported by the documentation you received from your customers is what makes the difference in most cases. If they know you are careful who you extend credit to, it makes you a better customer for them.

The document flow continues when you are ready to invoice your customer. You have a document in your hands which, in part, supports your request for payment. The document trail continues to a proof that not only did your product (or your service) arrive on time and met the quality expectations of your customer but, it is another stage of their commitment to honor the payment terms expressed in the purchase or work order initially.

When business owners understand that there are forms of financing which respond to the “document flow” on both sides of the delivery process, they are poised to maximize the funding which is likely available to them through purchase order financing, receivable financing (factoring) and, although not making funds available per se, credit terms from their best suppliers.

Since document driven financing starts and ends with the documents in a real time frame (generally with a written expectation of an end date) the financing can usually be at a more aggressive volume when needed and can retract to respond to slower market conditions as well.

Arranging for financing of this nature requires full information at the inception of the relationship with the lender. Showing the strength of your company, your customers and the abilities of your supplies allows you to maximize all aspects of managed cash flow.

The flexibility of knowing funds are proactive rather than reactive can be a real stress reliever.

Is it time to look into using one of your company’s most valuable resources, it’s documentation, to better plan for success and growth in 2014. Give me a call at 416-450-2648 Judi

To provide what you provide, you need help

November 12, 2013 at 3:42 pm | Posted in Uncategorized | Leave a commentWhether you are a manufacturer, distributor or supplier of raw materials, you need your customer to be able to commit to paying you! Why else would you extend credit to your customers?? Why would you put your business at risk to help your customers run their business?

So, look at the good business decisions you can make.

1. Expect cash payments from your customers

2. Expect creditability from your customers

3. Expect to spend time managing your receivables so they are paid in a timely fashion

4. Expect to grow your business within the limits of your financial means

OR……

Let us credit evaluate your customers for you

Let us manage your receivables and report to you daily

Let us expand your abilities to grow based on your strength

It’s up to you! Is it time for you to look at financing options which will have you enjoy growth and prosperity in 2014?

Your success should be recognized

May 27, 2013 at 8:27 pm | Posted in Uncategorized | Leave a commentRemember when you were a little kid and you got a gold star when you did well on an assignment? Oh, come on, I cant be the only person out there old enough to remember the excitement of being recognized for a job well done!

Your sales team, your office staff and your customers are all a part of your success and you will be amazed at the excitement you can build by rewarding them even in small ways.

Having a specialist discuss how to best launch a REWARDS programme for your business will take the stress out of the process and make it enjoyable for you as well. Even marking important dates and reaching goals can be a cause for celebration for your entire team. Try it out, see if it works for you as well as it did when you were 6 years old.

Let me introduce you to Leslie Priest. As a PROMOTIONAL CONSULTANT and also a caring business professional, Leslie will listen to your ideas and make your people feel special. Leslie describes herself as “A specialist providing strategic business solutions through promotional products, service awards, premium incentives, safety awards and branded apparel.”

You can reach Leslie through me or directly at:

Leslie Priest, CAS Promotional Consultant

T: 905-632-8196 | F: 905-632-3360 | W: http://www.talbot-promo.com

YOU CAN’T DO IT ALONE! YOU NEED A TEAM!

May 23, 2013 at 10:11 am | Posted in Uncategorized | Leave a commentHave you ever walked into a business and wondered why you feel uncomfortable? Why you cant wait to leave? Is there tension in the air that guests and customers can sense?

No matter how good you are at providing the services or the products you provide, your TEAM needs to be on their A game to support your efforts. Managing the issues your staff can go through is a job best left for the experts.

I know a expert who would help you set the guidelines so you can maximize your teams strengths. Paul Fini describes himself as a specialist in the “diagnostic of leadership, interpersonal conflict and team issues” and “executive coaching and team building to strengthen & align your team and improve overall leadership effectiveness”

You can reach Paul through me or connect with him directly at: http://www.fini.ca/

Remember, the best sports teams out there recognize the need for ongoing coaching and resolution of conflict. You know you cant manage all of the tasks, let an expert manage the TEAM and take your company to a new level of success!!

TA DA!!!! PRESENTING……YOU!!!!

May 22, 2013 at 4:55 pm | Posted in Uncategorized | 2 CommentsHow many times have you wished you had a better way to reach out to your customers, to get your message across to your customers? Isnt it time to get the job done by a specialist? One who works with you and your team to present you and your business in the best possible light…let me introduce you to:

Renee Brisson Khan of RBK Artworks is a wizard in the world of design.She will astound you with the work she is capable of and she looks forward to hearing your ideas for improving your sales tools. You know what your specialty is and when to bring outsourced specialists in to answer your needs. Get your message out by using EXPERTISE ON DEMAND. You can reach Renee at 647-802-2787 or renee@rbkartworks.com

It warrants being said again!!

January 3, 2013 at 2:14 am | Posted in Uncategorized | Leave a commentEveryday, I see files from companies looking to improve their cash flow position. There are many ways to do this of course but all solutions require that the owner of the company know what position they are currently in. Confused? Don’t feel bad, you are not alone. Most owners of businesses are not fully aware of the strengths their company has to tap into. Credit from suppliers can be the cheapest way to finance the growth of a business but you need to give these relationships the respect they deserve. Establish good terms and honour them. Borrowing against your collateral is another way to speed up the growth or stabilize your business. But, remember, collateral is a limited resource, regardless of how big your company is. Look at the security of your business as a mortgage. You can only have one first mortgage. Every other borrower will be in second, third or even fourth place behind the first security holder. You can be surprised to learn that liens are created by the simple act of signing a lease or arranging a new equipment loan. Get out your paperwork, ask your advisors what your current position is. And then, plan ahead for what it will take to maximize your business by minimizing your exposure!!!

The Cash Flow Gap

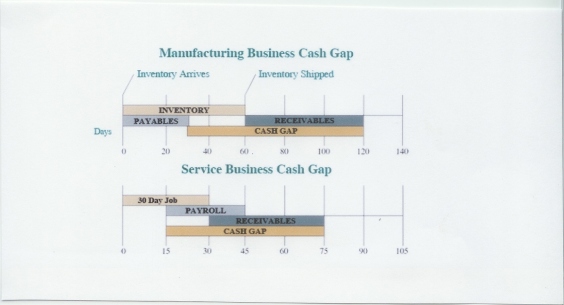

October 27, 2012 at 3:59 pm | Posted in Uncategorized | 1 CommentJust when you think you have thought of everything, you look at the calendar and you realize that there are 12 days before your customer pays you but only 4 days until payday for your employees!!!!

This is a typical cash flow gap. Many others exist! Regardless of industry, if you are extending credit to your customers and taking advantage of credit facilities from your suppliers, you will end up IN THE GAP more times than you think. You should think about the solutions to THE GAP before it happens (or at least before it happens again!)

This graph will give you some insights on THE GAP as it happens in both manufacturing and service companies. There are solutions and maybe it is time to look into them before THE GAP gets too wide to manage.

If you would like to close THE GAP, give me a call at 416-450-2648

Judi Johnstone “Letting the Cash Flow!”

Vice President, Business Development Eastern Canada

email: jjohnstone@fvf.ca website: http://www.fvf.ca

Cash flow is heating up this summer!!

August 14, 2012 at 12:04 pm | Posted in Uncategorized | Leave a commentThis has been a summer of unpredictable activity. Industries who would normally not be impacted by cash flow crunches are being hit fast and hard. As suppliers try to keep their customers payments in line, the customer at the end of the sales process is extending the payment times outside of usual boundaries.causing a double whammy in the cash flow crunch!

Factoring your receivables isnt the only answer. It is one of the answers you should be exploring if you find yourself wondering how to manage both the time and the cost of the credit you have extended to your customers.

Remember, sometimes YOU are the supplier! Other times, YOU are the customer!!!

In many cases, you are carrying the costs of the credit both times! Let’s talk sometime about your situation and see if we can help. Our website at www.fvf.ca will give you valuable information which can assist you in planning ahead.

Go into the 3rd quarter of 2012 with your money when you want it, not when your customer decides you can have it.

Blog at WordPress.com.

Entries and comments feeds.